Series 7 Exam Pro iOS App

Crush the Series 7 Exam and Bull Ahead in Your Finance Career with Series 7 Exam Pro!

Gear up to ace your FINRA Series 7 General Securities Representative Exam with Series 7 Exam Pro — the ultimate app for ambitious finance professionals aiming to sharpen their market savvy and regulatory expertise. Whether you're preparing to become a licensed stockbroker, trader, or expand your credentials within the securities industry, our comprehensive app provides all the tools you need to succeed.

Dive into an extensive array of exam-focused questions and in-depth explanations covering all essential facets of the Series 7 exam, including equity and debt instruments, options trading strategies, securities regulations, customer accounts, and portfolio management. With features like customizable quizzes, real-time progress tracking, and personalized feedback, you can zero in on your knowledge gaps, fine-tune your analytical skills, and build the confidence required to navigate the complexities of the financial markets.

Key Features:

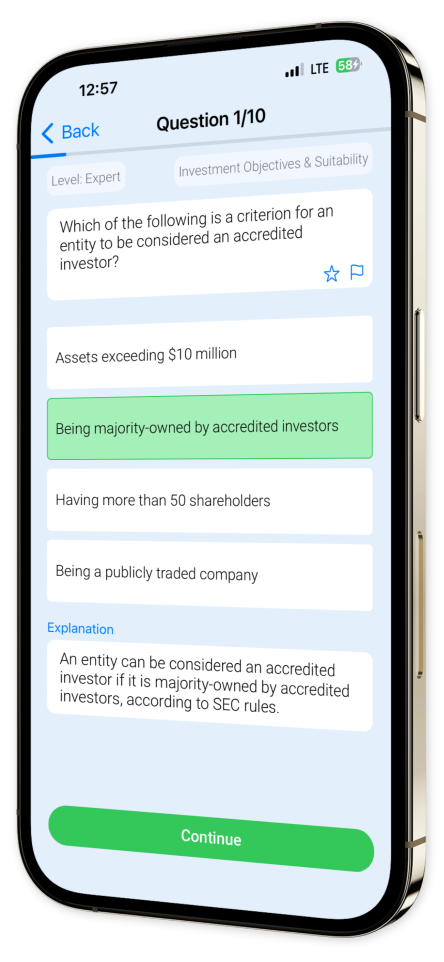

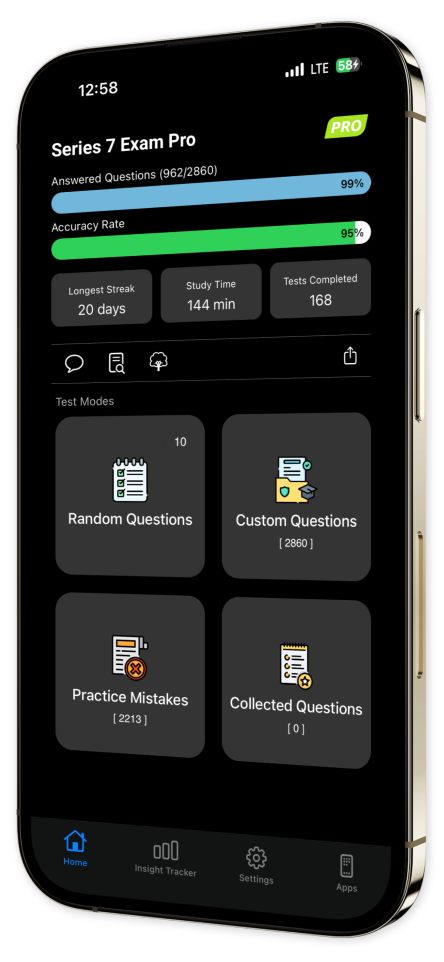

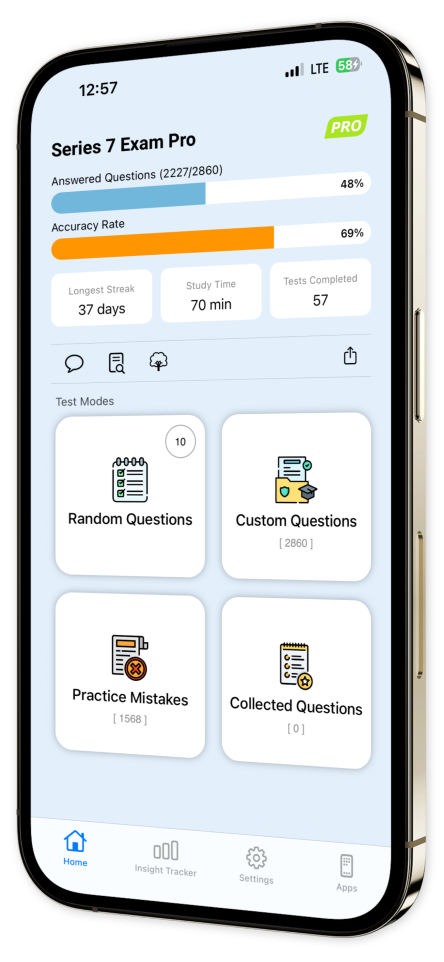

Robust Question Bank: Access thousands of practice questions that mirror the actual exam format.

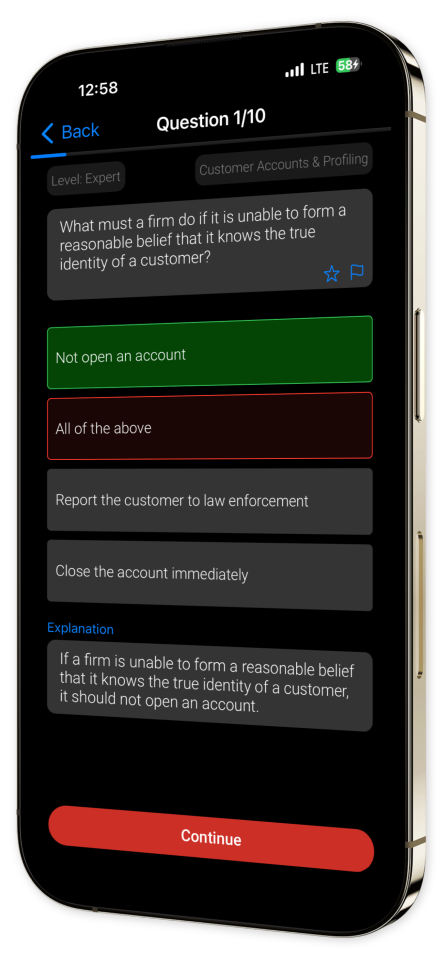

Detailed Explanations: Understand the reasoning behind each answer to deepen your industry knowledge.

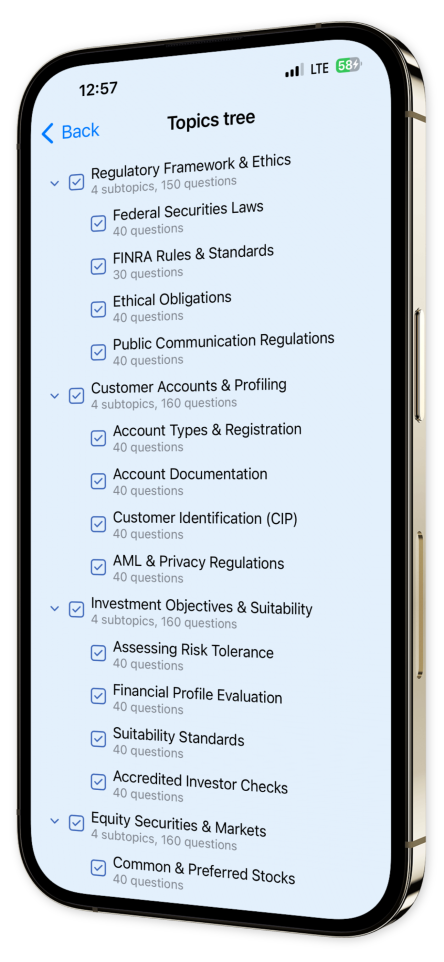

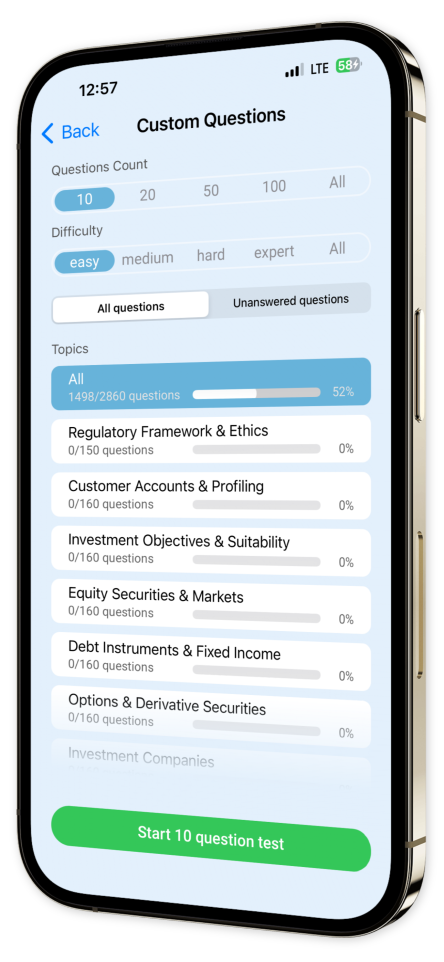

Customizable Quizzes: Tailor your study sessions by topic to focus on areas needing improvement.

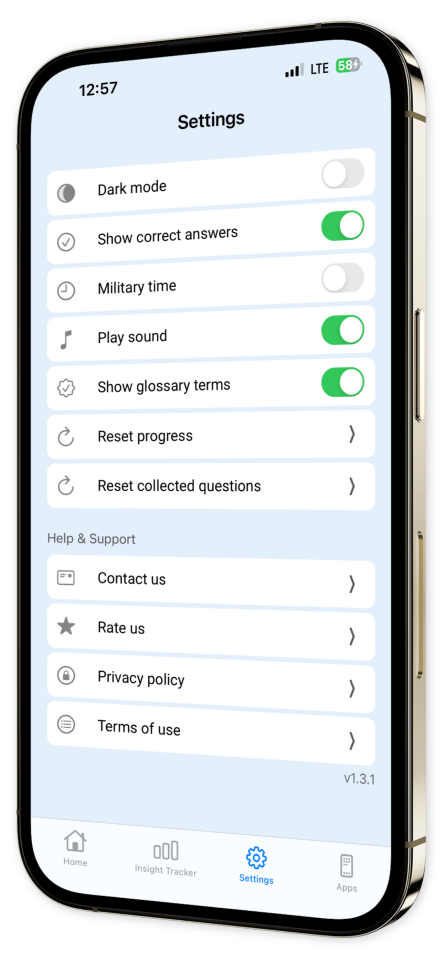

Progress Analytics: Monitor your performance metrics to stay on track with your study goals.

Elevate your career alongside successful financial advisors and securities professionals who have effectively prepared for the Series 7 exam using Series 7 Exam Pro. Enhance your market proficiency, unlock new career opportunities, and step confidently into your role as a licensed General Securities Representative.

Don't leave your future to chance. Download Series 7 Exam Pro now and kick-start your journey to becoming a top-tier financial professional today!

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

Under FINRA Rule 2010, what standard of conduct is required of firms and their associated persons?

A standard of reasonable diligenceA standard of utmost good faithA standard of reasonable careA standard of strict liability

FINRA Rule 2010 requires firms and their associated persons to observe high standards of commercial honor and just and equitable principles of trade, which is typically interpreted as a standard of utmost good faith.

Which of the following is not considered personally identifiable information (PII)?

Customer's nameCustomer's date of birthCustomer's account balanceCustomer's favorite color

A customer's favorite color is not considered personally identifiable information (PII). PII refers to information that can be used to identify an individual, such as their name, date of birth, or account balance.

Which of the following investments would be most suitable for a risk-averse investor?

High-yield bondsEmerging market stocksTreasury bondsVenture capital funds

Treasury bonds are considered to be one of the safest investments, making them suitable for a risk-averse investor.

What is the minimum annual income for a couple to be considered accredited investors?

$300,000$350,000$400,000$450,000

A couple can qualify as accredited investors with a combined income of $300,000 in each of the last two years and the expectation of the same income level in the current year.

Which of the following money market instruments is typically used in international trade transactions?

Treasury BillsCertificates of DepositBankers' AcceptancesCommercial Paper

Bankers' Acceptances are typically used in international trade transactions. They are short-term credit investments created by non-financial firms and guaranteed by a bank.

What is a policy loan in a variable life insurance policy?

A loan from the insurer to the policy ownerA loan from the policy owner to the insurerA loan from the insured to the beneficiaryA loan from the beneficiary to the insured

A policy loan in a variable life insurance policy is a loan from the insurer to the policy owner, using the cash value of the policy as collateral. If the loan is not repaid, the death benefit is reduced by the outstanding loan amount.

What happens to the SMA if an investor receives a margin call?

It increasesIt decreasesIt remains unchangedIt becomes negative

Receiving a margin call does not directly affect the SMA. The SMA only changes when there is an increase or decrease in excess equity.

Which of the following is not a qualified distribution from a Roth IRA?

Withdrawal after age 59.5Withdrawal for first-time home purchaseWithdrawal due to disabilityWithdrawal within five years of opening the account

Withdrawal within five years of opening a Roth IRA is not considered a qualified distribution.

What type of dispute is typically not suitable for mediation?

Disputes over contract termsDisputes requiring a legal judgmentDisputes between investors and brokersDisputes over the interpretation of financial data

Disputes requiring a legal judgment are typically not suitable for mediation. Mediation is best suited for disputes where a mutually acceptable resolution can be negotiated.

What is the purpose of regular monitoring in Best Execution Practices?

To ensure compliance with regulationsTo identify areas of improvementTo ensure the best possible result for clientsAll of the above

Regular monitoring in Best Execution Practices serves all these purposes - it ensures compliance with regulations, identifies areas of improvement, and ensures the best possible result for clients.